Why Credit Unions Can’t Ignore Leasing in 2026

Leasing as a Complement

For decades, auto lending followed a familiar pattern. Members financed vehicles through traditional auto loans, credit unions managed predictable terms, and affordability concerns were largely addressed through rates and loan length.

That model is starting to strain.

Vehicle prices have climbed, loan balances are higher than ever, and loan terms are stretching past six years just to keep monthly payments manageable. At the same time, delinquencies across the auto market remain elevated, signaling that longer and more expensive loans are not always aligning with how members experience affordability in real life (State of the Automotive Finance Market Report: Q3 2025).

In this environment, auto loans alone may no longer meet every member’s needs.

Leasing offers credit unions a way to respond, not as a replacement for traditional lending, but as a complementary option that provides payment flexibility, eases upfront cost pressures, and helps manage long-term exposure in 2026.

Why Loan-Only Strategies Are Losing Predictability

Auto lending, as credit unions have traditionally known it, is becoming less predictable.

Several forces are converging at once:

- Vehicles cost more than they used to

- Loan terms are extending to offset higher prices

- Monthly payments are harder for households to absorb

- Delinquencies are rising across the market

Together, these trends point to a growing mismatch between loan structures and how members manage their monthly finances.

Experian data shows that monthly payments have increased across every credit tier, not just among higher-risk borrowers. Even Prime and Super Prime members are feeling pressure as financing costs rise (Experian, SAFM Q3 2025).

To keep payments workable, lenders are increasingly extending loan terms, with most new loan growth occurring at 73 months or longer. While this can lower payments upfront, Experian data shows early signs of credit score decline at these extended terms. The issue is not borrower behavior, but structure. Longer loans leave less room for disruption over time.

Leasing Is No Longer a Niche Choice

One of the clearest shifts in the data is who is choosing to lease.

Nearly 86 percent of all new leases are held by Prime and Super Prime borrowers (Experian, SAFM Q3 2025).

This challenges the outdated perception that leasing is primarily for higher-risk or financially constrained consumers. Instead, strong borrowers are actively choosing leasing because it offers predictable monthly payments and shorter commitments.

For credit unions, this represents a meaningful repositioning moment. Leasing is no longer about serving a niche audience. It is about meeting the expectations of financially strong members who prioritize flexibility.

Leasing vs. Buying: How Sales Tax Changes the Math

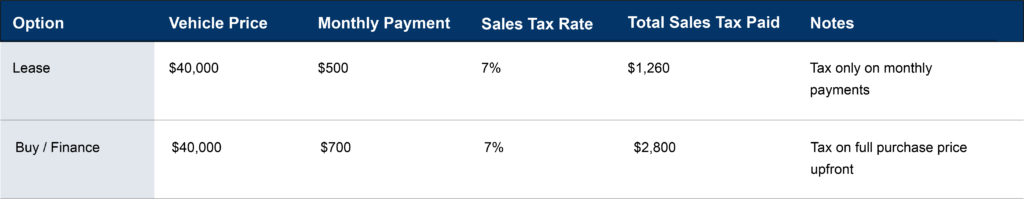

When members compare leasing and buying, they often focus on monthly payments or long-term ownership. What is frequently overlooked is sales tax, which can significantly impact overall affordability.

With a traditional auto purchase or financed loan, sales tax is typically applied to the full vehicle price upfront. On a $40,000 vehicle at a 7 percent tax rate, that results in $2,800 in sales tax, regardless of how long the vehicle is owned.

Leasing works differently. Sales tax is applied only to the monthly payments, not the full vehicle price. Over a standard 36-month lease, the total sales tax would be roughly $1,260.

The takeaway is simple: leasing spreads tax payments over time and reduces total tax exposure, making it a smart option for members focused on cash flow. This demonstrates how leasing not only lowers monthly payments but also reduces overall upfront costs, reinforcing the flexibility credit unions can offer members.

What Rising Delinquencies Really Signal

Delinquencies are often misunderstood. While they are typically discussed as a metric, at their core they reflect moments when payments no longer align with everyday financial realities.

A delinquency simply means a borrower is late on an auto payment. It does not automatically indicate default, repossession, or financial failure. Delinquencies are commonly measured at 30, 60, or 90 days past due.

When Experian reports that auto delinquencies are rising and remain elevated, it highlights ongoing affordability pressure across the market. Higher payments, tighter household budgets, and extended loan terms leave less room for disruption, even among otherwise stable borrowers (Experian, SAFM Q3 2025).

The takeaway is not that borrowers are becoming less responsible. It is that existing payment structures are increasingly out of sync with how people live month to month.

What Credit Unions Can Control Heading Into 2026

Credit unions cannot control vehicle prices, inflation, wages, or household expenses. They cannot force affordability where it no longer exists.

What they can control is how they show up when financing decisions are made.

When payment structures fall out of sync with everyday financial realities, the answer is not stricter lending. It is flexibility. Leasing offers a way to realign financing with how members actually manage their money by providing lower monthly payments, shorter commitments, and greater predictability.

As loan-only strategies face growing strain, leasing becomes less about product expansion and more about risk management. It provides a way to support payment flexibility, reduce long-term exposure, and retain Prime members who are already choosing leasing elsewhere.

Why Leasing Creates a Visibility Gap for Credit Unions

While banks and credit unions have gained share in traditional auto lending, captive lenders continue to dominate transactions where leasing plays a major role.

Captive lenders benefit from structural advantages at the dealership. They control lease offers, bundle manufacturer incentives, and simplify the point-of-sale experience. When leasing enters the conversation, credit unions are often not positioned to participate.

This does not reflect weaker lending performance. It reflects a visibility gap.

When a credit union does not offer leasing, the member does not stop shopping. They simply finance elsewhere. The risk is not that members will not pay. The risk is that credit unions will not be part of the decision at all.

CU Xpress Lease: Staying Present Where Decisions Happen

CU Xpress Lease provides a turnkey, risk-managed way for credit unions to enter leasing without operational disruption.

Designed to be scalable and structured, CU Xpress Lease allows credit unions to participate in lease-driven financing decisions while maintaining alignment with broader portfolio goals. It offers a practical path forward as member expectations evolve and affordability dynamics continue to shift.

The question for credit unions is not whether members will lease. It is whether they will lease with you.

CU Xpress Lease offers a turnkey, risk-managed solution that keeps credit unions present in lease-driven financing decisions, helps retain Prime members, and supports members in managing affordability as loan-only strategies face growing strain.

Explore CU Xpress Lease and prepare your credit union for what’s next.